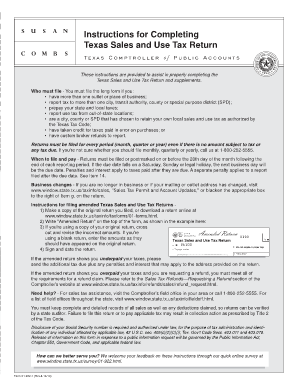

TX Comptroller 01-114 2019-2026 free printable template

Show details

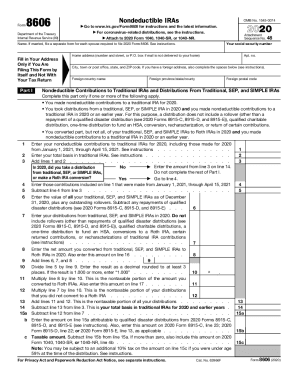

PRINT FORM 01-114 Rev.1-18/39 DDDD 26100 0111400W011839 Instructions in English b. Texas Sales and Use Tax Return a. See instructions Form 01-922. Do not staple or paper clip* c* Taxpayer number Do not write in shaded areas. d. Filing period e. Blacken this box if your mailing address has changed* Show changes by the preprinted information* in business. Write in the date you went out of business. locations is out of business or has changed its address. g. You have certain rights under...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas form sales download

Edit your texas form sales online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas sales return pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 01 114 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 01 114 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 01-114 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 01 114 printable

How to fill out TX Comptroller 01-114

01

Obtain the TX Comptroller 01-114 form from the Texas Comptroller's website or local office.

02

Fill in the top section with your business's name, address, and contact information.

03

Indicate the type of application you are submitting (e.g., new application, renewal).

04

Provide your Texas Taxpayer Identification Number if applicable.

05

Complete the section detailing the products or services you provide.

06

Verify that you've selected the correct exemption category for your situation.

07

Review the instructions for any additional documentation required.

08

Sign and date the form at the bottom, certifying the information provided is accurate.

09

Submit the completed form to the appropriate address as specified in the instructions.

Who needs TX Comptroller 01-114?

01

Those who are applying for a sales tax exemption in Texas.

02

Businesses that qualify for certain exemptions provided by the state.

03

Non-profit organizations seeking tax-exempt status for sales tax purposes.

04

Entities that engage in activities or sales that may be exempt from state sales tax.

Fill

texas comptroller use tax return

: Try Risk Free

People Also Ask about rt number texas comptroller

What is a 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

What is the 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

Do I need a W-2 if I have a 1040?

Yes, you can still file taxes without a W-2 or 1099. Usually, if you work and want to file a tax return , you need Form W-2 or Form 1099, provided by your employer. If you did not receive these forms or misplaced them, you can ask your employer for a copy of these documents.

How do I file my own taxes step by step?

How to File Your Taxes This Year: 6 Simple Steps Step 1: Determine if You Need to File. First things first. Step 2: Gather Your Tax Documents. Step 3: Pick a Filing Status. Step 4: Choose Between the Standard Deduction or Itemizing. Step 5: Choose How to File. Step 6: File Your Taxes.

When can I file my taxes for 2023?

IRS kicks off 2023 tax filing season with returns due April 18.

How exactly do you file taxes?

Choose how to file taxes There are three main ways to file taxes: fill out IRS Form 1040 or Form 1040-SR by hand and mail it (not recommended), file taxes online using tax software, or hire a human tax preparer to do the work of tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find texas form 01 114 fillable?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 01 114 pdf in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the texas return online electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your texas comptroller form 01 114 in seconds.

How can I fill out texas state tax return on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your texas form 01 114. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is TX Comptroller 01-114?

TX Comptroller 01-114 is a form used for reporting unclaimed property in the state of Texas.

Who is required to file TX Comptroller 01-114?

Businesses, government entities, or organizations that hold unclaimed property for more than a specified period are required to file TX Comptroller 01-114.

How to fill out TX Comptroller 01-114?

To fill out TX Comptroller 01-114, provide details such as your business information, the type of unclaimed property, the owner information, and the amounts, following the instructions provided with the form.

What is the purpose of TX Comptroller 01-114?

The purpose of TX Comptroller 01-114 is to report unclaimed property to the state and ensure compliance with Texas unclaimed property laws.

What information must be reported on TX Comptroller 01-114?

Information that must be reported includes the holder's details, the type of property, the owner's last known address, the amount of property, and any related documentation.

Fill out your TX Comptroller 01-114 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

01 114 is not the form you're looking for?Search for another form here.

Keywords relevant to texas return sample

Related to texas sales tax form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.